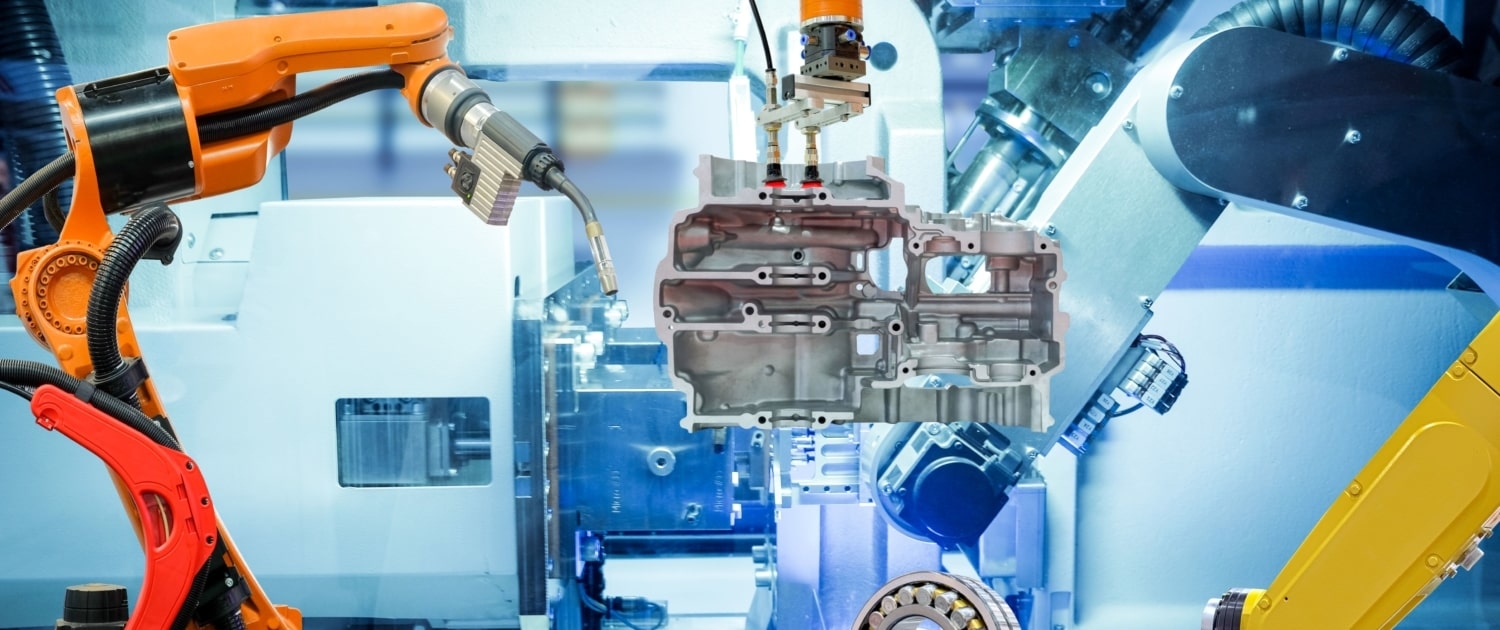

Equipment Leasing is vital to most UK businesses. WestWon have been working in the equipment leasing sector for years, providing finance packages to thousands of companies throughout the UK. During this time, we have encountered almost every conceivable request for equipment lease financing. From vehicles, office equipment to manufacturing machinery and construction plant. There isn’t much we can’t secure on a deal, so whatever your company needs to lease, contact WestWon and let us help you find the best finance package. With access to over 50 UK funders we can provide you with industry leading rates.

Equipment Finance

Equipment leasing is the flexible alternative to asset purchasing, and it is perfect for anyone who needs to scale up their operation. Leasing is also a flexible way to replace old or damaged equipment, in order to make the business more productive and improve output. By Paying monthly instalments over an agreed period from 1 – 5 years, you can conserve your precious cash. For more benefits on WestWon’s finance and leasing solution, please see below.

Why Choose WestWon?